Cryptocurrency trading over the weekend

The crypto market never closes. You can trade Bitcoin, Ethereum, and other digital assets 24/7. The prices often remain volatile over the weekend, which creates profit opportunities, but sudden price crashes, which are common, make this market a risky business. Also, low weekend liquidity can result in price manipulation or larger spreads.

Weekend stock market trading (IG, Nasdaq, FTSE, etc.)

Some brokers offer weekend trading on stock indices: Nasdaq 100, FTSE 100, Dow Jones (DJIA), DAX (Germany 40) and so on. Note that these weekend markets don’t directly reflect official exchange prices: they are influenced by broker algorithms and futures market activity. These markets can be an opportunity to hedge existing positions against risks in regular stock markets.

Also, they can be a good indicator for Monday’s open — indexes track futures market movements.

Pros and cons of holding trades over the weekend

Trading over the weekend is a big dilemma. If you are a long-term trader, you might prefer to keep your positions open during weeks and months. Any temporary volatility won’t affect your trading. Also, if you are a swing trader who has one trade last for up to several days, you might consider keeping trades open over a weekend.

To keep trading over the weekend, be sure you’re trading on the right timeframe. H4, daily timeframes may provide you with this opportunity.

If you do hold a trade over the weekend, you may suffer big losses if the market is shocked by unexpected news that you couldn’t have predicted. If you close trading before the weekend, you might lose an opportunity for a profitable trade. Imagine how frustrating it would be for a price to continue moving your way after the weekend, but for the good entry point to have passed you by.

So, should you keep a trade open over the weekend? If you expect an accurate answer, you won’t find it here. There are many factors that you will have to take into consideration before keeping the trading open, and certain benefits and drawbacks of this decision.

In the end, it’s up to you.

Advantages

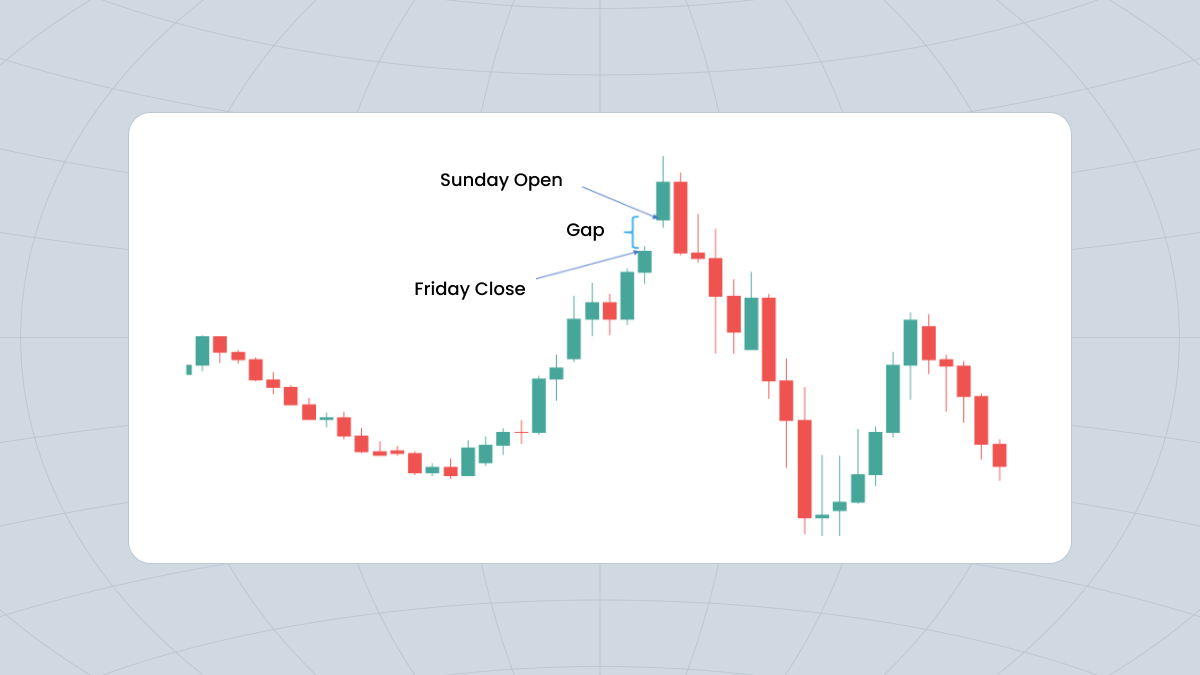

Large price movements aren't always bad. It can lead to significant profit opportunities when the market reopens on Monday. Also there are fewer minor fluctuations which is good for long-term traders.

Disadvantages

However, the gaps are unpredictable: there’s always high risk of losses as you have limited control over trades. You can’t adjust positions during the weekend, so take all the risk management measures in advance.

Unsure where to start trading? FBS is here to help you out. Open an account and begin now!