What Does ESG Mean for a Business?

For businesses, embracing ESG principles transcends mere corporate responsibility—a fundamental strategy that drives sustainable growth, enhances brand reputation, and attracts investors and customers. In forex trading, companies with robust ESG commitments can significantly influence market perceptions and currency stability.

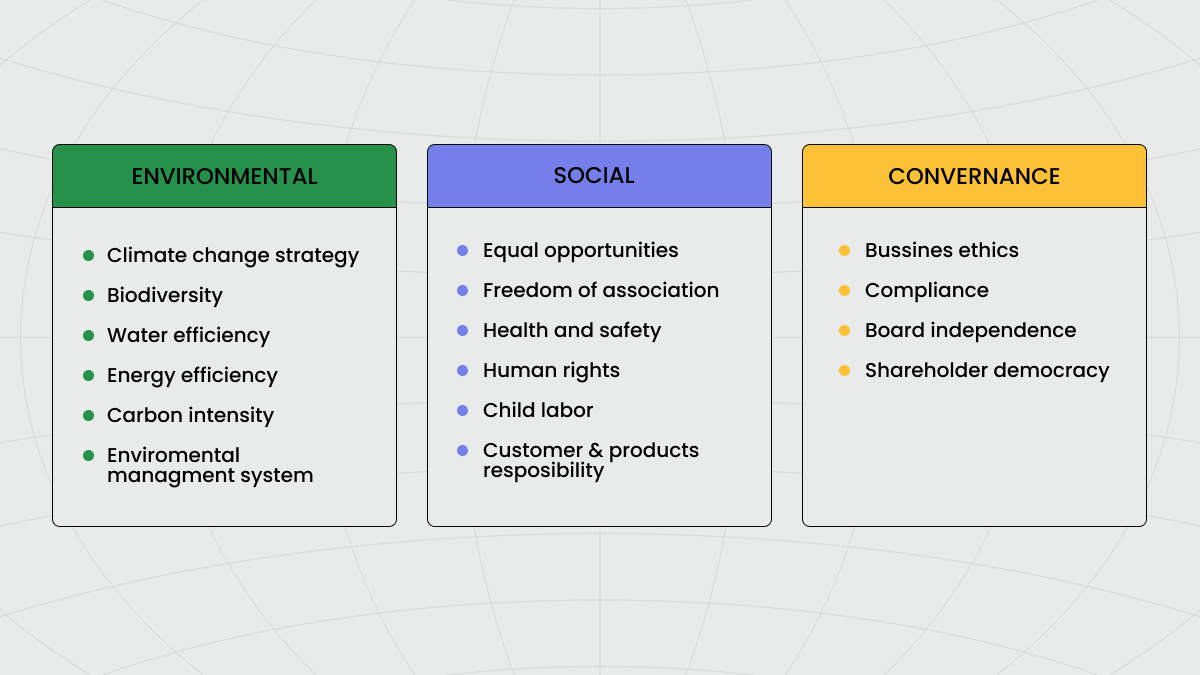

ESG criteria enable businesses to identify and manage risks that could substantially impact financial stability. Environmental risks like climate change can disrupt operations and supply chains, while social risks, such as labor practices and community relations, affect employee productivity and brand loyalty. Governance risks, including transparency and ethical lapses, can lead to legal challenges and damage to reputation.

Moreover, companies that proactively integrate ESG principles often innovate, develop sustainable products, and adopt efficient processes that meet changing consumer preferences. This not only provides a competitive edge but also opens up new markets.

Financially, a strong ESG profile facilitates access to capital as investors increasingly seek out companies committed to sustainable practices, often resulting in favorable borrowing costs and investment terms. Additionally, managing ESG factors effectively enhances long-term shareholder value, with investors viewing strong ESG practices as indicative of better financial performance and lower volatility.

How Do I Know Which Investments Are ESG?

Identifying ESG investments requires understanding the various tools, metrics, and resources available to assess the ESG compliance of potential investment opportunities. This involves due diligence and using reliable ESG ratings from specialized organizations for forex traders and investors.

ESG Ratings and Reports

MSCI, Sustainalytics, and Morningstar provide ratings based on a company's environmental practices, social responsibility, and governance. Ratings range from leader (high compliance) to laggard (poor compliance), helping investors assess ESG performance.

Companies publish sustainability reports detailing their ESG strategies, achievements, and commitments, offering insights into their sustainability efforts.

Third-Party Verification

Third-party audits by independent auditors verify data accuracy in sustainability reports, enhancing their reliability.

Certifications like GRI, LEED, and ISO 14001 indicate ESG compliance, providing ESG management and reporting frameworks.

Investment Screening Tools

Financial service providers offer tools to screen investments against ESG criteria, helping investors build ethically-aligned portfolios.

Modern platforms feature robo-advisors specializing in ESG, which use algorithms to manage investments based on ESG criteria, simplifying the process for those without expertise.

The Bottom Line

ESG investments represent a shift towards sustainable and ethical investment practices. They influence forex trading by linking a country's ESG performance to its currency stability. Research shows that ESG investments outperform traditional investments due to better management and risk mitigation. The growth in ESG investments is expected to continue, increasing the availability of ESG data and impacting forex trading by offering insight into country risk and economic stability.

FAQ

How Are ESG Scores Calculated?

ESG scores, central to understanding environmental social governance, are derived by evaluating a company's adherence to environmental, social, and governance standards. Advisors and firms construct these scores using data from various sources, including sustainability reports and public disclosures.

Why Should You Choose ESG Investing?

ESG investing offers a dual benefit: alignment with personal ethical values and potential for robust financial returns. Companies with firm ESG profiles are often better equipped to manage risks and leverage opportunities, enhancing long-term profitability. This investment strategy, focusing on firms prioritizing sustainable and ethical practices, appeals to those considering corporate impact on environmental and social factors.

Is ESG Controversial?

The debate around ESG investing centers on the subjective interpretation of good environmental, social, and governance practices. Critics question the impact of ESG criteria on investment returns and argue it may politicize investment decisions. However, supporters of ESG investing maintain that it identifies essential risks and opportunities overlooked by traditional financial analyses, emphasizing the long-term benefits of sustainability in business.

How Can You Find ESG Investments?

Investors looking to adopt ESG investing strategies can consult advisors in this area or turn to firms offering dedicated ESG funds. Many stock indexes now include ESG-focused companies, facilitating more accessible access to these investments.

Conclusion

ESG investing is more than a trend; it's becoming a fundamental aspect of how individuals and institutions allocate their capital. It represents a comprehensive approach considering financial returns, environmental stewardship, social responsibility, and governance quality. For those in the forex market, integrating ESG considerations into trading strategies is a move towards responsible investing and a potential path to enhanced profitability and risk management.