The EURUSD pair is showing strength, trading near its daily high after climbing above key support levels. Technical indicators suggest the pair has potential for more gains, though momentum is somewhat mixed. The Federal Reserve is expected to announce an interest rate cut this week, which is contributing to the weakness of the US Dollar. Meanwhile, the Japanese Yen also strengthened, adding to pressure on the Dollar as central banks prepare for their respective rate decisions. The Eurozone's trade surplus came in lower than the previous month, while strong US manufacturing data did little to lift the Dollar's mood.

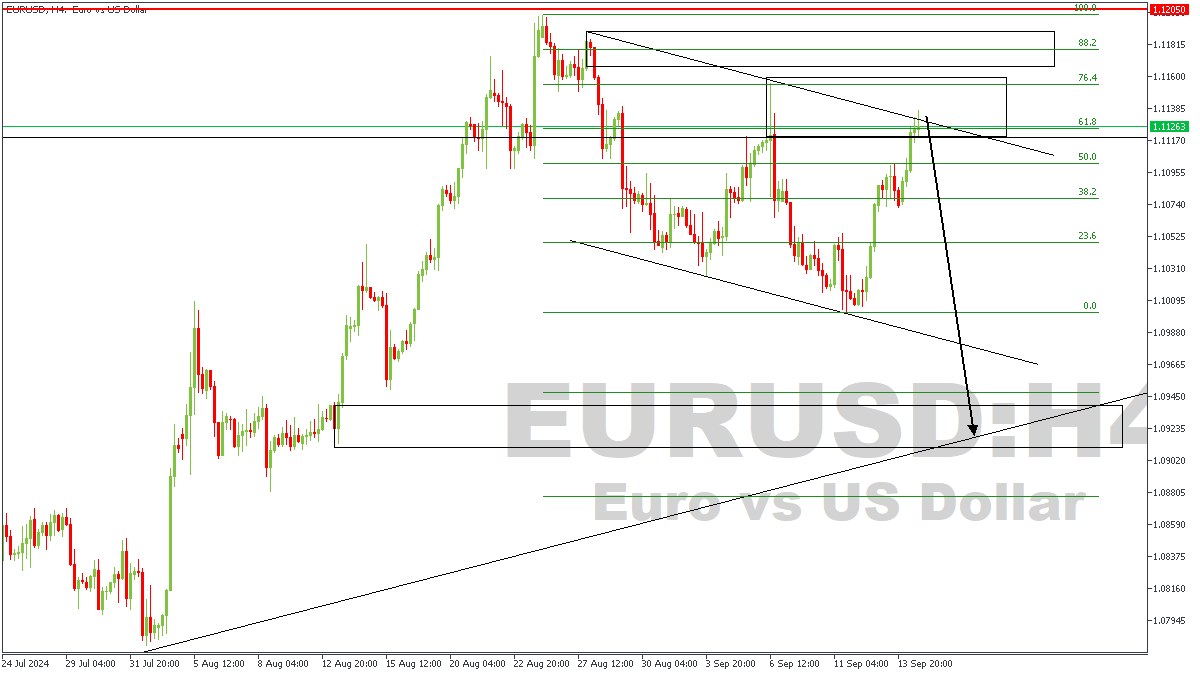

EURUSD – H4 Timeframe

EURUSD on the 4-hour timeframe is currently trading near the trendline resistance of a descending channel overlapping the supply zone. The 61.8% of the Fibonacci retracement tool also fits within the supply zone, lending extra confluence to the bearish sentiment. The target is the trendline support highlighted on the chart.

Analyst’s Expectations:

Direction: Bearish

Target: 1.09450

Invalidation: 1.11815

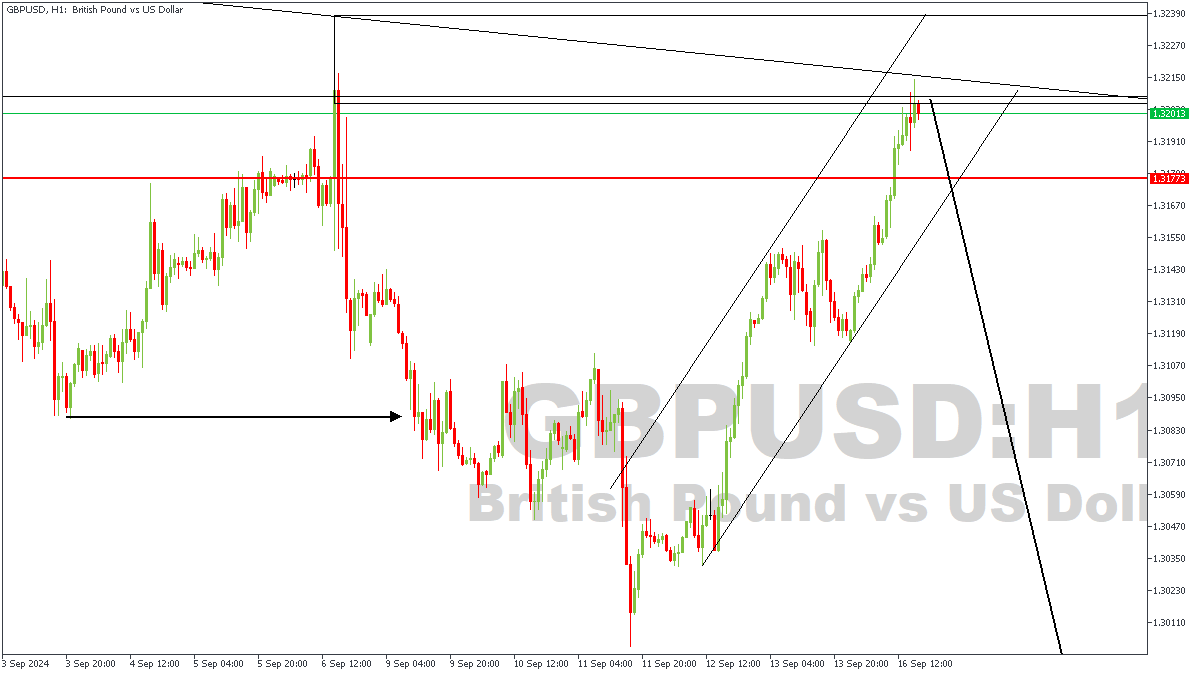

GBPUSD – H1 Timeframe

There is an intersection of two resistance trendlines as seen on the 1-hour timeframe of GBPUSD. The break below the trendline support of the rising channel will serve as the crucial confirmation of and entry towards the bearish sentiment. The required confluence here is the break-and-retest of the trendline support – remember that!

Analyst’s Expectations:

Direction: Bearish

Target: 1.30470

Invalidation: 1.32461

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.