BTC Strength Signals Risk-On Behavior — but Caution Remains

- Bitcoin is holding above $85,800, shifting market sentiment from "extreme fear" into a less bearish zone.

- USD strength vs. crypto may waver slightly in the short term if BTC rallies, as seen in risk-on currencies like AUDUSD, NZDUSD, and GBPUSD.

- That said, significant outflows from crypto funds (e.g., the $795M weekly outflow) indicate broader uncertainty and may support USD strength as a safe haven—especially USDCHF and USDJPY.

Bitcoin Dominance Rising — Liquidity Rotation in Play

- BTC's market dominance has increased to 62.95%, hinting at a risk rotation away from altcoins.

- This could indicate increased global demand for USD liquidity (to exit alt positions), keeping DXY supported and pairs like EURUSD under pressure.

- Equities start selling off, and JPY and CHF could benefit from being traditional safe havens, particularly in USDJPY and EURCHF.

Crypto Policy in the U.S. — Watching for USD Impact

- Bitcoin is supported by U.S. policy buzz:

- Potential Strategic Bitcoin Reserve.

- New York's proposal to use BTC for state payments.

- If these gain traction, they could weaken USD sentiment slightly as they signal long-term diversification away from fiat reserves.

Short-Term Volatility + Long-Term Accumulation

- Despite ETF outflows, institutional holdings are growing (e.g., 3,459 BTC added by Strategy).

- Crypto dips are being bought, which may limit USD upside against risk assets — but unless BTC breaks $86K+, upside FX pressure is muted.

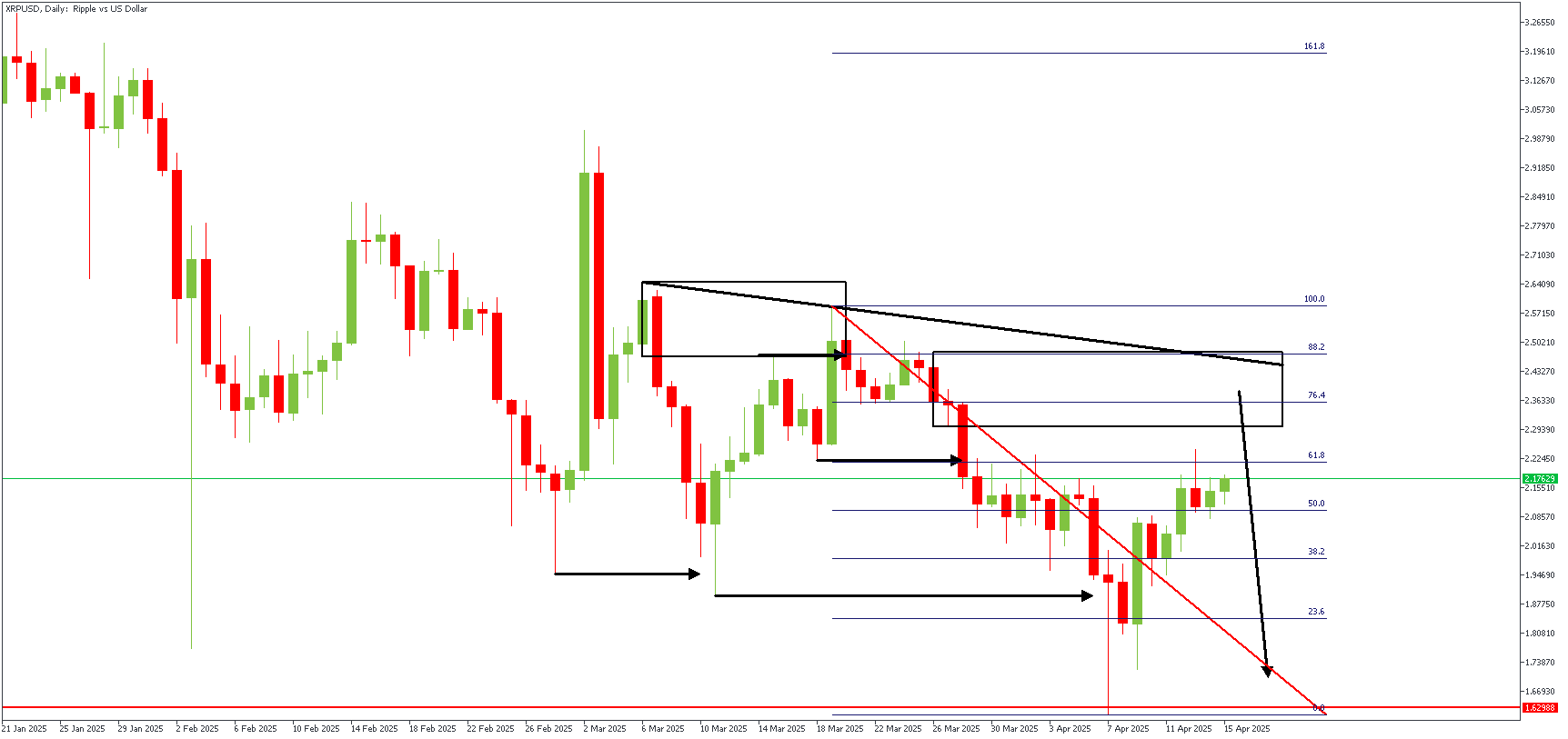

XRPUSD – D1 Timeframe

The slope of the trendline resistance indicates that the price is in a downtrend. The double bearish break of structure, Fibonacci retracement level, and the highlighted supply region provide additional confluences for a bearish sentiment.

XRPUSD – H4 Timeframe

.png)

On the 4-hour timeframe chart of XRPUSD (Ripple), we discover an elusive SBR pattern at the top of the previous bearish momentum. As a result of all the aforementioned confluences, the rational expectation would be a rejection from the supply zone for a bearish continuation.

Analyst's Expectations:

Direction: Bearish

Target- 1.71218

Invalidation- 2.60182

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.