Choose stocks to buy

Selecting the right stocks is one of the most important stages of the investment process. Companies with huge growth potential and sustainable financial capabilities can be selected only after a careful study. First off, determine your personal risk tolerance and what you are trying to achieve with your investments. Are you looking for stable income in the form of dividends, long-term growth, or a mixture of both?

Study the companies listed on the NSE. Note their financial statements, performance in the market, position of companies in the industry, and its prospects for further growth. It is also useful to keep in mind the trends of the market, and economic factors that can influence these companies. Never make a decision based solely on brand awareness or popularity; investments must be based on fundamental and technical analysis.

For instance, banking, telecommunications, and production of consumer goods are always in demand due to stable income and huge market presence. Some companies also pay dividends to ensure a stable income stream beyond capital gains.

Another important thing to keep in mind is diversification. Investing in several companies from different sectors helps traders reduce or avoid risks.

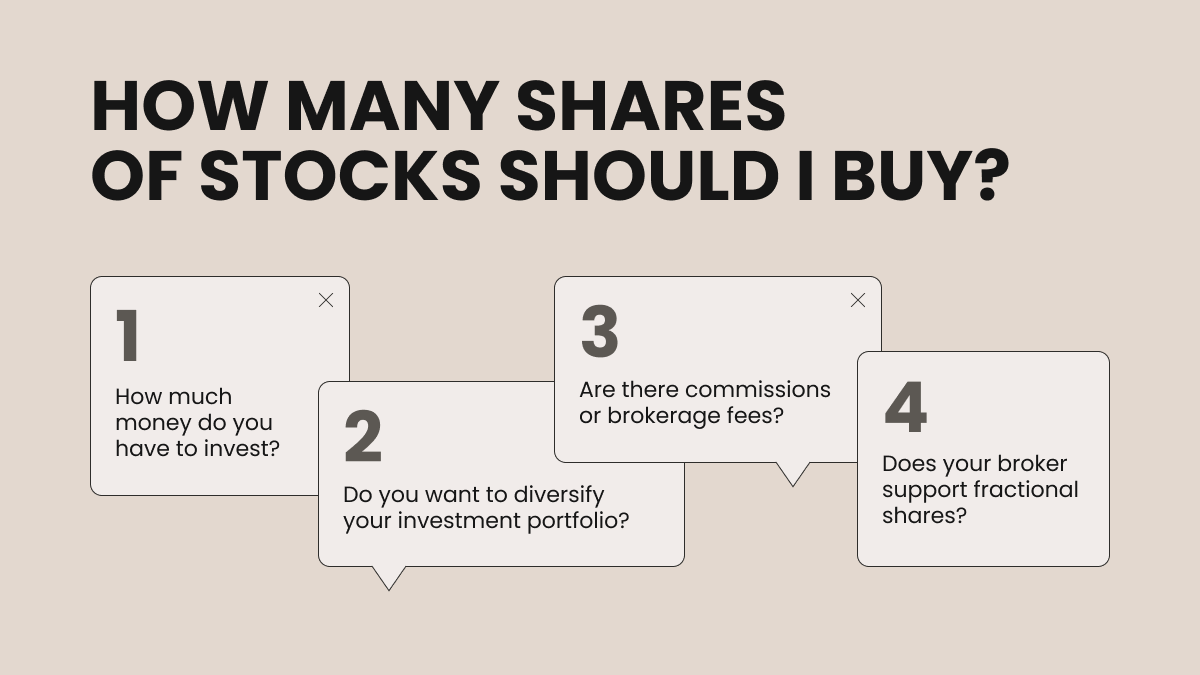

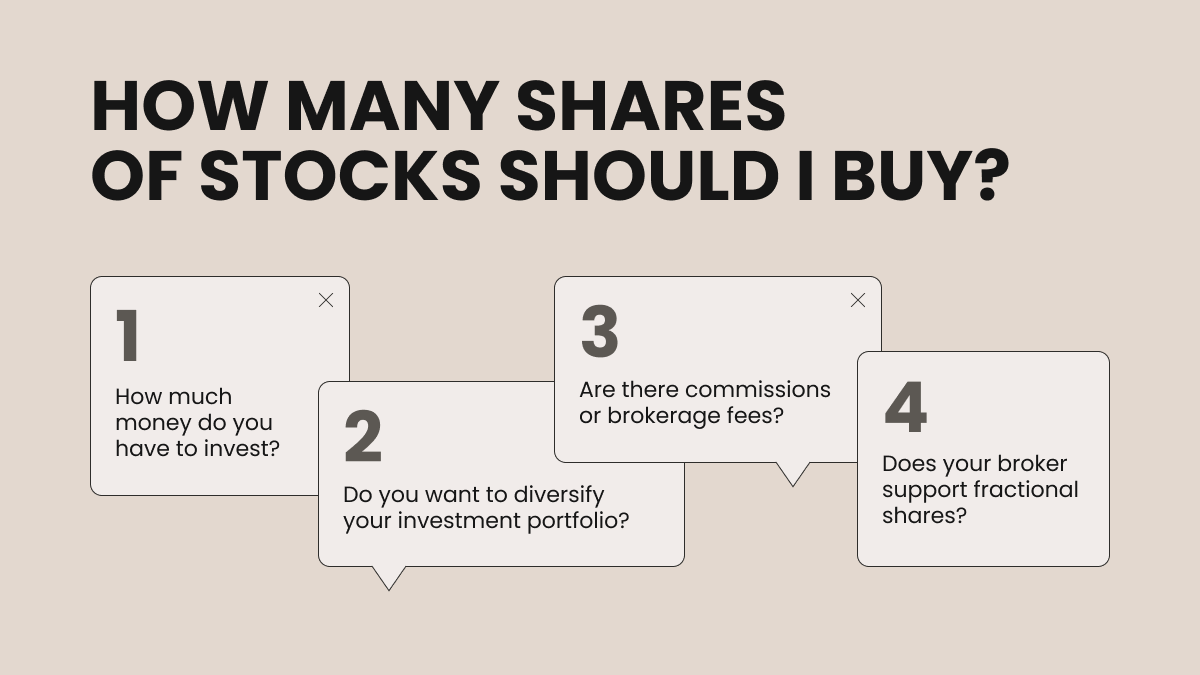

Decide how many shares to buy

Having selected the right stocks for your portfolio based on your investment strategy, the next decision is how many shares to buy. At this point, use your judgment to make a decision based on your investment budget, risk tolerance, and desired portfolio diversification.

Start by thinking about your overall investment budget and the amount that you will commit to each share. It is often prudent not to invest all your money in one share, but spread the risk that comes with the price fluctuations of that particular share. If, for example, you are investing KES 100 000, you might commit KES 20 000 each to five different shares, based on their potential and your confidence in their performance.

You also need to know the minimum number of shares you can buy. On the NSE, the minimum number of shares is usually 100. You need to make sure your budget can allow you to purchase that many.

The other consideration is the market price of the shares. If the shares are of high value, and you are considering purchasing many of them, then this investment requires more capital. You can buy a larger quantity of lower-priced shares, but that comes with its own risks as well.

If buying at least 100 shares on the NSE is beyond your budget, especially for more expensive stock, keep in mind the alternative of CFD trading. With the CFD broker FBS, you can easily speculate on stock prices without having to dish the cash to actually purchase shares. This is less risky, quicker, and easier with FBS.

Fund your brokerage account

The last step before buying shares is topping up your brokerage account. That means transferring money from your bank account to your brokerage account so that you have enough capital to buy shares. To fund your account, follow these steps:

Transfer methods

Most brokers in Kenya provide several ways to deposit cash into your account on their platform, such as bank transfer, mobile payment platforms like M-Pesa, and sometimes credit/debit cards. Choose the method that is most convenient and least costly to you.

This broker is famous for its huge variety (over 200) of ways to deposit capital in the account with local currencies. The minimum deposit with FBS, $5, and its commission of 0% ensures that your transaction will be efficiently processed with few charges. Most of the deposits are instant; however, the timing may differ due to bank transfers.

Minimum deposit

Be aware of any minimum deposit requirements your broker might have. Because the amount varies from one broker to another, if you don’t have much money at first, this information may affect your choices of instruments. While some brokers take KES 10 000 as the minimum deposit, FBS makes trading cheap with only $5 for an initial deposit.

Currency considerations

Also, be aware of potential currency exchange fees and conversion rates if the trading account is opened in a different currency than the one your bank account is in. This applies to nearly all brokers who run their international businesses in US dollars or other currencies. Notably, FBS supports transactions in your local currency, thus avoiding needless conversion fees and making depositing easier.

Processing time

The time for money to be added to your trading account varies. Bank transactions require several days, while mobile ones are generally instantaneous. Log in and make sure you have funds available if you are planning to invest. You should also know that FBS supports your local currency, making any deposit way easier and avoiding possible conversion delays or fees.

Your ability to place purchase orders and trade will be enabled immediately after your account is topped up. Keep in mind that on platforms like FBS, you’re allowed to trade CFDs, which might give more room for flexibility in your investment strategy.

Summary

With diligence and proper knowledge, one can have a very successful career investing in stocks here in Kenya. Carefully selecting a good stockbroker, opening and funding a brokerage account, and choosing shares, will go a long way in setting a solid foundation for any investment portfolio. Platforms like FBS make buying stocks easier, and there are other trading opportunities added by CFDs that give more strategic investment opportunities.

Entering the stock exchange market, it is important to stay abreast of all relevant trends and updates. Keep up with financial news, review your investments regularly, and consult experts whenever necessary. This will help you make better sense of the market risks, reduce the risks involved, ensure the conformity of your investments to your financial goals, and eventually attain success on the Kenyan stock market.

Thank you for reading, and happy investing!